Support the Stuttering Foundation

Our continued work depends on your help

You can help!

Make a fast, easy, secure donation now.

The Stuttering Foundation is a recognized 501(c)(3) nonprofit organization and your contribution is tax-deductible to the extent allowed by law.

You can rest assured that your gifts will go to support our program services.

Featured Fundraisers

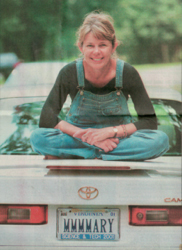

The Mary E. Weadon Fund For Public Awareness

Learn More

James Campbell Stuttering Memorial

Learn More

Financial Audit

The Stuttering Foundation is a recognized 501(c)(3) nonprofit organization and your contribution is tax-deductible to the extent allowed by law.

View Audit

Other Ways to Give

Charitable contributions, and bequests to the Foundation are tax-deductible, subject to limitations under the code. We welcome gifts of appreciated stock for which you may deduct full market value for income tax purposes.

-

Gifts of Cash

Mail checks to:

Stuttering Foundation of America

P.O. Box 11749

Memphis, TN 38111-0749

(800) 992-9392 | (901) 761-0343

Fax: (901) 761-0484 -

Stocks and Securities

Contact Tom at Merrill Lynch at 901-756-2067.

-

Remainder Trusts

Check with your financial adviser for details.

-

Tribute Program

Memorialize a deceased family member or friend. Honor a birth, anniversary, graduation, wedding, or any important occasion in the name of a loved one.

-

Employer Matching Gift

Many companies will match your gifts. Check with your employer.

-

Annuities

Check with your financial adviser for details.

-

Leave a Legacy

It’s easy to include the Stuttering Foundation in your will, and it will do a world of good. Here is sample wording: “I give and bequeath to the Stuttering Foundation of America the amount of $____ (or ___% of my residual estate).” Your legal advisor can help you with the final wording.

-

Donate Retirement Assets

New tax laws on 401(k) offer new options. Check with your financial adviser for details.

-

Donation Form

Designate a gift through the United Way. To give to the Stuttering Foundation through the United Way, you can write in "Stuttering Foundation of America, P.O. Box 11749, Memphis, TN 38111" on the pledge form. If donations are done over the Internet, you may have to contact your local United Way for instructions on how to contribute to the Stuttering Foundation. If we can assist you with this, please contact us at 800-992-9392.

Designate a gift through the United Way. To give to the Stuttering Foundation through the United Way, you can write in "Stuttering Foundation of America, P.O. Box 11749, Memphis, TN 38111" on the pledge form. If donations are done over the Internet, you may have to contact your local United Way for instructions on how to contribute to the Stuttering Foundation. If we can assist you with this, please contact us at 800-992-9392.

We are a tax-exempt organization under section 501(c)(3) of the Internal Revenue Code and are classified as a private operating foundation as defined in section 4942(j)(3).

Podcast

Podcast Sign Up

Sign Up Virtual Learning

Virtual Learning Online CEUs

Online CEUs Streaming Video Library

Streaming Video Library